I developed an application using Y! BOSS Search APIs, Linguistics, Machine Learning and Google App engine.

Here is the Application Live. Use it anytime:

Here is the Source code for the Project:

This is O.R.Senthil Kumaran's blogspot on programming and technical things. The title is a line from "Zen of Python".

unix_time_1234567890

unix_time_1234567890

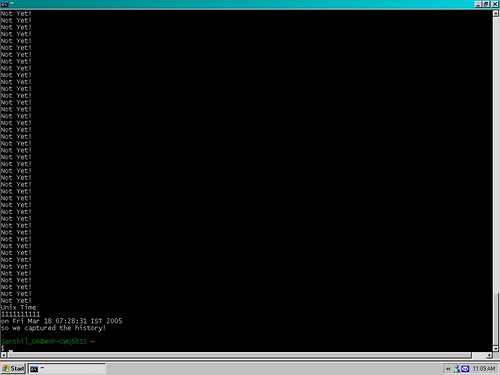

This was fun. I could manage to capture it again. This time it was with Vijay.

Previously, while at Dell, along with another friend, Raj, had captured 1111111111.

Sent Form 8233

For the PyCon Tutorial Compenstation.

I request you to print the attached PDF. Complete the Necessary

details (lower half) from PSF and please FAX

a) My Form 8233 with PSF details.

b) PSF Authorization Letter.

To my FAX Number: 91 80 30501090.

Bug-queue - http.client.HTTPMessage.getallmatchingheaders() always returns []

> Further investigation ( grep -r getallmatchingheaders Lib/* ) reveals

> that in addition to having no tests, and being implemented incorrectly

> in http.client, getallmatchingheaders() is called only once, in

> http.server; that code is also broken (I reported this yesterday in

> #5053).

>

> Maybe Python 3 is where getallmatchingheaders can make a graceful

> goodbye (and a 2to3 conversion added?).

>

> Python tracker http://bugs.python.org/issue5053

> that in addition to having no tests, and being implemented incorrectly

> in http.client, getallmatchingheaders() is called only once, in

> http.server; that code is also broken (I reported this yesterday in

> #5053).

>

> Maybe Python 3 is where getallmatchingheaders can make a graceful

> goodbye (and a 2to3 conversion added?).

>

> Python tracker http://bugs.python.org/issue5053

PyCon Tax information

On a go forward basis, we are taking the position that the PSF won't issue tutorial payments without a W-9 for US persons (US citizen or resident alien) or an 8233 with ITIN for foreign persons (but see below).

Non-US Taxpayers

============

For non-US persons ('non-resident aliens', in the IRS lingo) we need to withhold 30% of the payment unless they are citizens of a country which

has a tax treaty with the USA which allows a lesser rate on personal service income. e.g. for Canada, UK, DE the withholding rate is currently zero. The PSF has to file a 1042-S information return (which is equivalent to a 1099) regardless; there is no lower limit on the compensation.

http://www.irs.gov/publications/p515/ar02.html NRA Withholding

http://www.irs.gov/pub/irs-pdf/p519.pdf US Tax Guide for Aliens

http://www.irs.gov/publications/p901/ar02.html Countries with treaties

To avoid withholding we need to get a Form 8233 from each presenter each year, assuming they are citizens of a treaty country.

http://www.irs.gov/pub/irs-pdf/f8233.pdf On-line Form 8233

http://www.irs.gov/instructions/i8233/ Instructions

This is very easy to complete, except that it requires an ITIN ('individual taxpayer identification number) the first time, and that is a bother:

http://www.irs.gov/pub/irs-pdf/fw7.pdf On-line Form W-7

http://www.irs.gov/taxtopics/tc857.html Instructions - short

http://www.irs.gov/pub/irs-pdf/p1915.pdf Instruction Booklet

The catch on the W-7 is the US Social Security Administration has to deny a Social Security Number application and that denial has to be provided along with the W-7. That's a separate application to the SSA.

There is an exception to this: if the tutorial presentation compensation can be considered a honorarium, then a letter from the PSF to that effect will allow

the SSA denial process to be skipped, per Exception 2a (page 25 of p1915). The PSF has discussed this with the IRS, and they agree that the tutorial

compensation can be considered an honorarium. This means that the applicant would need a letter from the PSF requesting the tutorial presentation, and the applicant would fill in 'Python Software Foundation' on line 6g as the 'company' and provide a copy of the letter along with his/her W-7 application.

So the process would be as follows, assuming the presenter doesn't already have a US ITIN:

Fax the PSF an 8233 (without an ITIN) and a fax number. The PSF will complete the lower half and FAX a copy back along with the authorizing letter. Submit a W-7 with the 8233, acceptable identification documentation (see Pub 1915, typically a certified copy of a passport), and the authorizing letter to the IRS to get the ITIN. This should take 4 - 6 weeks. Send the ITIN back to the PSF on an updated 8233. This will allow the PSF to avoid the withholding. If the presenter has no other US source income, there would be no taxes owed on amounts lower than $3300, and no 1040NR need be filed in that case.

http://www.irs.gov/localcontacts/article/0,,id=101292,00.html

Without the ITIN, the PSF is required to withhold 30%. To get it back by filing a 1040NR plus Schedule C, the presenter would need an ITIN, anyway. So

if he is a citizen of a treaty country and cares about the 30%, he should get an ITIN, send the 8233, and avoid both withholding and filing (assuming no

other US income).

The PSF will offer the option of 30% withholding if the presenter chooses not to supply the document, or cannot do so in time. The presenter could later

acquire an ITIN and file for a refund up to three years after the due date of the return. At least, that is the filing deadline for a refund on a US 1040;

the foreign filer should confirm that deadline for a 1040NR. However, it is probably simpler for all concerned to delay payment until the ITIN is

available for the 8233.

Non-US Taxpayers

============

For non-US persons ('non-resident aliens', in the IRS lingo) we need to withhold 30% of the payment unless they are citizens of a country which

has a tax treaty with the USA which allows a lesser rate on personal service income. e.g. for Canada, UK, DE the withholding rate is currently zero. The PSF has to file a 1042-S information return (which is equivalent to a 1099) regardless; there is no lower limit on the compensation.

http://www.irs.gov/publications/p515/ar02.html NRA Withholding

http://www.irs.gov/pub/irs-pdf/p519.pdf US Tax Guide for Aliens

http://www.irs.gov/publications/p901/ar02.html Countries with treaties

To avoid withholding we need to get a Form 8233 from each presenter each year, assuming they are citizens of a treaty country.

http://www.irs.gov/pub/irs-pdf/f8233.pdf On-line Form 8233

http://www.irs.gov/instructions/i8233/ Instructions

This is very easy to complete, except that it requires an ITIN ('individual taxpayer identification number) the first time, and that is a bother:

http://www.irs.gov/pub/irs-pdf/fw7.pdf On-line Form W-7

http://www.irs.gov/taxtopics/tc857.html Instructions - short

http://www.irs.gov/pub/irs-pdf/p1915.pdf Instruction Booklet

The catch on the W-7 is the US Social Security Administration has to deny a Social Security Number application and that denial has to be provided along with the W-7. That's a separate application to the SSA.

There is an exception to this: if the tutorial presentation compensation can be considered a honorarium, then a letter from the PSF to that effect will allow

the SSA denial process to be skipped, per Exception 2a (page 25 of p1915). The PSF has discussed this with the IRS, and they agree that the tutorial

compensation can be considered an honorarium. This means that the applicant would need a letter from the PSF requesting the tutorial presentation, and the applicant would fill in 'Python Software Foundation' on line 6g as the 'company' and provide a copy of the letter along with his/her W-7 application.

So the process would be as follows, assuming the presenter doesn't already have a US ITIN:

Fax the PSF an 8233 (without an ITIN) and a fax number. The PSF will complete the lower half and FAX a copy back along with the authorizing letter. Submit a W-7 with the 8233, acceptable identification documentation (see Pub 1915, typically a certified copy of a passport), and the authorizing letter to the IRS to get the ITIN. This should take 4 - 6 weeks. Send the ITIN back to the PSF on an updated 8233. This will allow the PSF to avoid the withholding. If the presenter has no other US source income, there would be no taxes owed on amounts lower than $3300, and no 1040NR need be filed in that case.

http://www.irs.gov/localcontacts/article/0,,id=101292,00.html

Without the ITIN, the PSF is required to withhold 30%. To get it back by filing a 1040NR plus Schedule C, the presenter would need an ITIN, anyway. So

if he is a citizen of a treaty country and cares about the 30%, he should get an ITIN, send the 8233, and avoid both withholding and filing (assuming no

other US income).

The PSF will offer the option of 30% withholding if the presenter chooses not to supply the document, or cannot do so in time. The presenter could later

acquire an ITIN and file for a refund up to three years after the due date of the return. At least, that is the filing deadline for a refund on a US 1040;

the foreign filer should confirm that deadline for a 1040NR. However, it is probably simpler for all concerned to delay payment until the ITIN is

available for the 8233.

Subscribe to:

Posts (Atom)